Blogging about VAT when you are Sound Recordist is very boring – even more boring than doing the VAT report – except of course if you might get some money back…

So I just thought I would jot this down for everyone who is on the fixed rate scheme in the UK – that’s the one where you pay a fixed percentage each month and you can’t normally claim anything back. You can however claim VAT back on capital items over £2000. Most people know that, but lots of people, including accountants, think that this has to be more than £2000 spent on one single item. That’s not true! Here is the rule in question from the HMRC website:

It must be a single purchase of capital goods with a VAT-inclusive price of £2,000 or more. That doesn’t mean you are restricted to claiming back the VAT on a single item – for example, you could buy a pizza oven, fridge and dishwasher, as long as you buy them at the same time from the same supplier and the price is more than £2,000 including VAT.

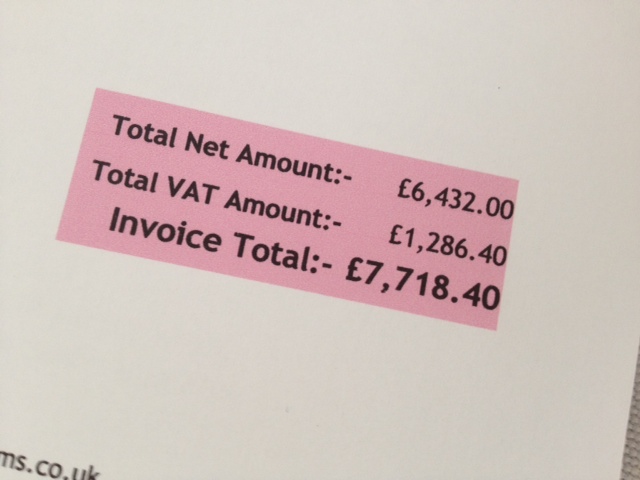

So the lesson there is that if you are buying sound recording kit – buy it all together from one place, on one invoice and if the total including VAT is over £2000 you can claim the VAT back. That’s hundreds every time.

The full text on claiming for capital items on the fixed rate scheme is here – I’m not an accountant, so you’d best check yourself before you take my advice.

http://www.hmrc.gov.uk/vat/start/schemes/flat-rate.htm#8

No responses yet