MICROLIGHTS – FINAL CALL FOR FILM TRAINEES! The final round of applications for MicroLights is now open. […]

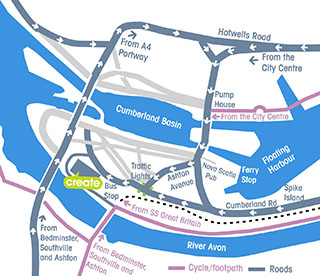

The Western Freelance branch is hosting a learning and networking event on Friday 4 February 2011. The […]

The University of Bath and Wiltshire College are holding an on line open week for the Foundation […]

I’m sometimes asked about routes into television and have to answer that the career structure can be […]